Baby Boomers and their Exit from Small Business

How the end of an era is signaling an investment opportunity

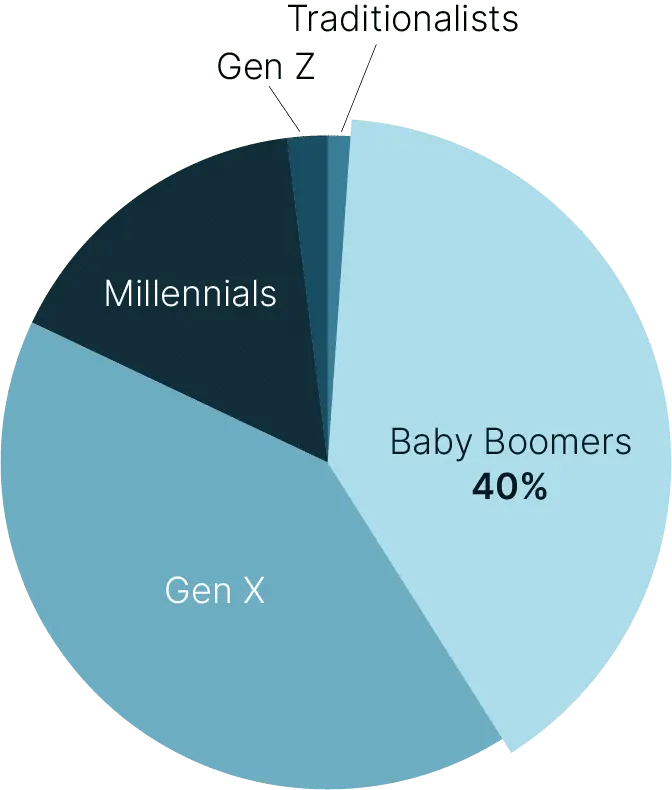

40% of small businesses are owned by Baby Boomers

As a significant number of people born between 1946 and 1964 approach retirement, a unique investment opportunity is emerging. This milestone for Baby Boomers is fueling momentum in small business sales, causing the landscape of ownership to undergo a significant transformation.

According to Forbes, this generation holds ownership of 40% of small businesses and franchises. This dominance appeals to a market of potential buyers because established businesses often present a more enticing prospect than starting from the ground up.

But like any business acquisition, there are both advantages and challenges. The key question for investors is identifying whether these opportunities align well with their portfolio objectives.

Weighing the Options

A perk to established businesses is the availability of information. There are historical financials, data, etc. that you can assess before committing to the sale. This security of information can be comforting to a buyer looking for a less risky investment.

The business’ reputation has also already been built, and people are aware of the products and services. Immediately following the acquisition date, there is a loyal customer base to work with.

But, along with the advantages are some challenges to consider. Oftentimes, a dedicated customer base is skeptical about new ownership, particularly if the small business owner had direct interaction with them. There is usually a high expectation for the new owner to continue to be heavily involved in the community.

Employee dynamics and existing structures are in place. As the new owner you have to decide to lean into those established relationships or potentially replace employees with those that better align with your future vision.

Small business owners have sweat equity in their businesses. So, they tend to be very particular about finding the right buyer. Post-sale business success is a paramount concern, and maintaining current employees and a positive community impact can also be high priorities. Identifying the right buyer and establishing an appropriate purchase structure is essential to uphold these aspects of the business.

Tradition Over Trend

Many businesses owned by the Baby Boomer generation have a practical approach. Typically, they aren’t high-tech and high-speed scaling companies. They penetrate sectors of business that cater to local mom and pop shops, such as business services, retail, construction and contracting, and food and beverage.

With Millennials and GenZ drawn to businesses that are techcentric, innovative, and nontraditional, these traditional industries are at risk for a lack of interest by potential successors. Although these other businesses may excite the younger generations, there is often an undertone of uncertainty and risk. The more sensible industries could yield a more stable financial gain.

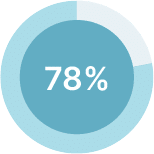

As of 2020, 78% of Baby Boomer-owned small businesses were profitable, which makes them the most profitable age group of small business owners, or “franchise wonders” according to Guidant Financial.

78% of Baby Boomer-owned small businesses are profitable

Financing Solutions

Regardless of the stage of business, looking ahead at financing options is key to deciding whether or not timing is right. There are multiple financing routes to consider:

- Traditional Bank Loans

- One of the most common options for small business purchases, these types of loans often offer favorable interest rates and terms. However, this requires a quality credit score, a detailed business plan, collateral, and a large down payment.

- Small Business Administrative (SBA) Loans

- These loans are backed by the U.S. Small Business Administration, which provides a level of security for lenders. These loans typically have more flexible terms than a traditional bank loan and are perfect for a purchaser who might not qualify for conventional financing or have as much capital available for the down payment.

- Seller Financing

- In this situation, the current owner of the business acts as the lender. The buyer pays the seller in installments over an agreed upon period of time with interest. This arrangement can be coupled with traditional bank financing to prevent a large cash outlay during an acquisition. Seller financing can benefit both parties: it assures the seller a steady income and gives the buyer more flexible financing and transaction certainty.

- Deal Structuring Alternatives

- Beyond conventional financing, there are a number innovative ways to structure an acquisition. These arrangements can include earn-outs, equity rollovers, partnerships, and royalty agreements, among others. These approaches can offer mutual advantages, tailoring the deal to suit both buyer and seller needs.

Each of these financing options offers benefits tailored to the financial circumstances of both sellers and buyers.We recommend working with a trusted financial and legal advisor to find the strategy that best aligns with your specific needs.

A Unique Impact

As the evolution of businesses moves from one generation to the next, there is a distinctive impact on our economy. Not only are these sales felt by the buyer and the seller, but the change in ownership is experienced by the communities in which these businesses are deeply rooted.

So, while this decision is unique to you, its impact is much larger than that. Navigating this transition requires careful consideration and a strategic approach from financing to relationships to community involvement. Although the stakes feel high, the outcome can be favorable in a variety of ways when approached appropriately.

If you’ve ever considered selling your business or are just interested in learning more about the process, reach out to our team for a no-commitment conversation.

© 2023 The Premiere Group

1431 Cinnamon Hill Ln #104, Columbia, MO 65201